The types of taxes and their applications on products and services is defined by administrators at the institution level. However, individual cores can decide to override the tax definitions at their institutions to fit their needs. This can be done on both equipment and services.

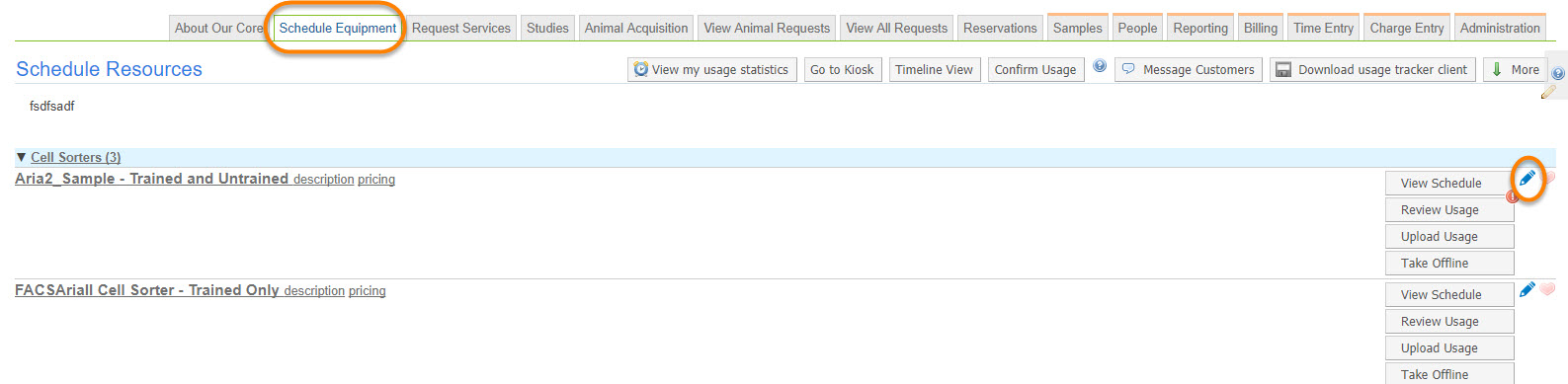

On Equipment

From the Schedule Equipment tab, click the edit (pencil) icon beside the equipment for which you wish to adjust the tax.

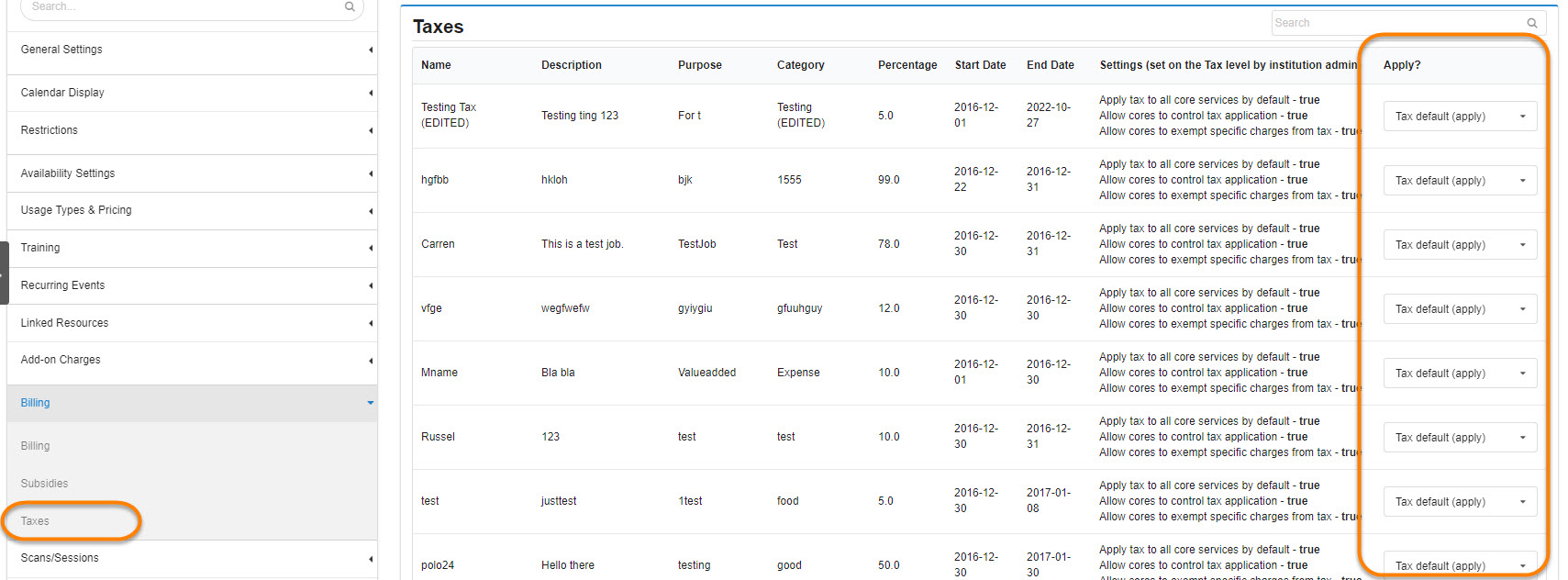

Under the Billing section, click on "Taxes". All the taxes established at the institution-level will display. For each tax, you may decide how you wish to apply the tax to your equipment by selecting from three choices displayed in the drop-down box:

- Tax default: This option applies institution-level parameters to this piece of equipment.

- Always: Always apply this tax to this piece of equipment.

- Never: Never apply this tax to this piece of equipment.

Selections in the Tax sections automatically save.

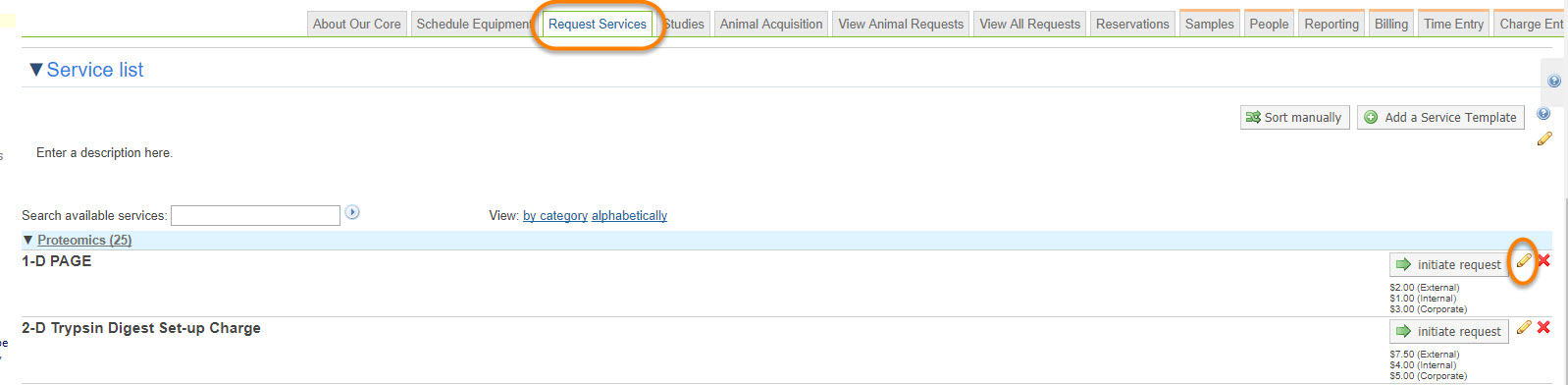

On Services

From the Request Services tab, click the edit (pencil) icon beside the service for which you wish to adjust the tax.

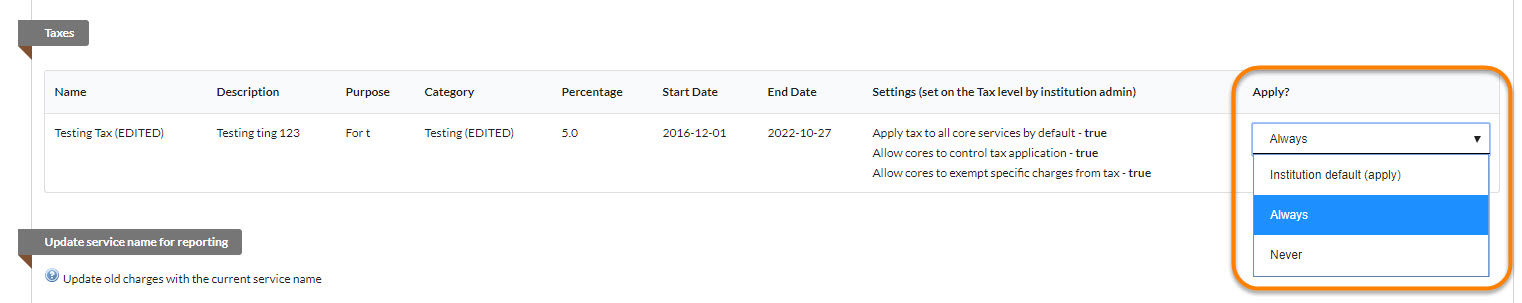

Navigate to the section titled "Taxes". Taxes established at the institution-level that may apply to this service will display. For each tax, you may decide how you wish to apply the tax to your service by selecting from three choices displayed in the drop-down box:

- Institution default: This option applies institution-level parameters to this service.

- Always: Always apply this tax to this service.

- Never: Never apply this tax to this service.

When you have completed your selections, click the "Save" button.